Four months after Onecoin’s London event in 2016, a blockchain expert named Bjorn Bjercke was contacted by a Japanese recruitment agency. He received an exciting employment offer. A Bulgarian cryptocurrency startup was recruiting for a chief technical officer. Bjercke would receive a car and an apartment, as well as a lucrative annual salary of almost £250,000.

He enquired what he is supposed to do in the company. What will the job description be? The salesperson explained that it was a cryptocurrency company that had been around for a while. But it does not have a blockchain. They wanted him to build a blockchain for them.

Bjercke said that he was “quite interested,” but he needed to know which company he would be working for. The recruiter hesitated at first, but eventually told Bjorn that the company was Onecoin.

Rise of Bitcoin

Satoshi Nakamoto, a pseudonym for an unknown individual or group of persons, designed Bitcoin in 2008. The currency’s use began to rise after its implementation was released as open-source software in 2009.

In a short period of time, Bitcoin became a big success and is now accepted for payments in many parts of the world. As a result, a large number of millionaires are created. The global testimonies of Bitcoin were incredible.

A man invested $27 in a bitcoin at $0.1 in 2009, and by 2013 had sold one bitcoin for over $1,200, making him $886,000. Another person invested $1,000 in bitcoin at $0.2 in 2009, and by 2013 had realised $8 million.

By mid-2016, Bitcoin’s value had risen from a few pennies to hundreds of dollars per coin. This led to a flurry of enthusiasm among investors. At that time, cryptocurrency was only breaking into the mainstream as a concept. Many people were interested in participating in this unusual new possibility. People wanted to put their money into something that would deliver them massive returns in a short period of time. This was the ideal opportunity to con people.

Birth of Cryptoqueen:

Ruja Ignatova called herself the Cryptoqueen. She enticed individuals to invest billions of dollars after telling them she had designed a cryptocurrency to compete with Bitcoin.

Ruja Ignatova’s journey, like many others, began modestly. It’s a typical rags to riches story with a twist. The self-proclaimed queen of cryptocurrencies was born in Sofia in 1980. But she was only ten years old when she moved with her family to Germany. She later graduated in Economics from the University of Konstanz. Ignatova continued her education at Oxford and began her career as a management consultant with McKinsey and Company.

Also Read: 5 Points to Focus Before Investing in Cryptocurrency

She was leading a good lifestyle, but in 2012, she had her first setback. A metallurgical plant in Bavaria that Ruja and her father Plamen Ignatov had purchased declares bankruptcy under mysterious circumstances. The court intervenes and convicts her to fourteen months in prison for fraud. In addition, the trustee of the group accuses her of stealing at least one million Euros.

The next year, Ignatova ventures into the exciting new world of cryptocurrency. She and Sebastian Greenwood, launched “BigCoin,” but it was a flop. But that didn’t deter Ignatova from returning to the crypto world. In 2014, the future “queen of cryptocurrencies” is ready to return with Greenwood. She eventually launched the project that will make her both popular and notorious around the world: “OneCoin.”

According to Ignatova’s predictions, OneCoin was the new revolution that would bury BitCoin. Her zeal was quickly recognised in her home country. She was named “Entrepreneur of the Year” in 2014.

But Bulgaria wasn’t enough for Ignatova. She had high ambitions and desired to expand internationally. To promote “OneCoin”: meetings, presentations, and conventions were held in various nations and locations. At Wembley Stadium, one such meeting was conducted.

The Wembley Stadium Event that Changed Everything

For the Onecoin, the convention at Wembley was a watershed moment. Dr. Ruja took the stage at Wembley Arena in front of thousands of loving fans in early June 2016. She informed the audience that OneCoin was on track to become the world’s largest cryptocurrency “allowing everyone to make payments everywhere.”

According to Dr Ruja, OneCoin was the “Bitcoin Killer”. “No one will be talking about Bitcoin in two years!” she exclaimed. From the podium, she rattled off astounding numbers: two million active users and a valuation of 4.5 billion euros, amassed in less than a year and a half of activity.

People from all around the world began to invest their wealth in OneCoin in the hopes of achieving enormous returns immediately. According to documents obtained by the BBC, British citizens spent about €30 million on OneCoin in the first six months of 2016, including €2 million in a single week, and the rate of investment might have escalated following the Wembley extravaganza. More than €4 billion was invested from numerous countries between August 2014 and March 2017.

The investments were not restricted to the United Kingdom, Europe, or even the United States or Canada, but also included Pakistan and Uganda. Investments came from more than 200 nations. China, Germany, the United Kingdom, and the United States made the majority of the investments.

Fall of Onecoin

Despite the successful front, irregularities began to emerge. The English judiciary began working on the “OneCoin” case in 2016. But it was not until 2017 that the fractures in the “cryptocurrency of the century” became more obvious.

The inauguration of a long-promised exchange that would allow OneCoin to be converted into cash continued to be postponed. The investors became increasingly concerned and worried. This was supposed to be resolved at a meeting in October 2017 in Lisbon, Portugal. However, the organisers were surprised, when she did not show up. Calls and mails went unanswered. Her whereabouts were unknown to the Sofia headquarters. On October 25, 2017, she boarded a Ryanair flight from Sofia to Athens, just two weeks after her Lisbon no-show. Then she vanished without a trace.

Ruja’s brother, Kostantin, was temporarily put in charge of OneCoin. He attempted to carry on as if nothing had happened. The house of cards, on the other hand, was on the verge of collapsing. Greenwood was arrested in 2018. Konstantin was apprehended at a Los Angeles airport in 2019. He was pleaded guilty to money laundering and fraud and now faces decades of imprisonment .

What exactly was Onecoin?

OneCoin was a Ponzi scheme disguised as a cryptocurrency. The hoax, which was started in 2014 by self-styled cryptoqueen Ruja Ignatova, drew millions of investors over a two-to-three-year period.

It was expected to work in the same way as other digital currencies. The cryptocurrency’s maximum supply was 120 billion coins. OneCoin could be mined as well as used to make payments. It was also meant to have an e-wallet. OneCoin advertised itself as a cryptocurrency, but it never had a blockchain to back it up.

According to sources, it was a SQL server with a database instead of blockchain technology. A ordinary SQL server database is not the same as a genuine coin. It was up to the database manager to change it whenever he pleased. The inevitable conclusion was that the OneCoin website’s soaring statistics were useless. They were just numbers that a OneCoin employee typed into a computer. Also, the project had its own platform and was not traded on any cryptocurrency exchanges.

Methods used to spread the word about Onecoin

Dr. Ruja’s knew that established MLM sellers with large downlines were the ideal vehicle to market her coin. This was OneCoin’s secret to success. It was a classic pyramid scheme, complete with a coin as the “product.” Multi-level marketing (MLM) was used to encourage people to sell educational materials to their friends and relatives. The courses were part of a multi-level marketing (MLM) plan in which purchasers were rewarded for recruiting more people.

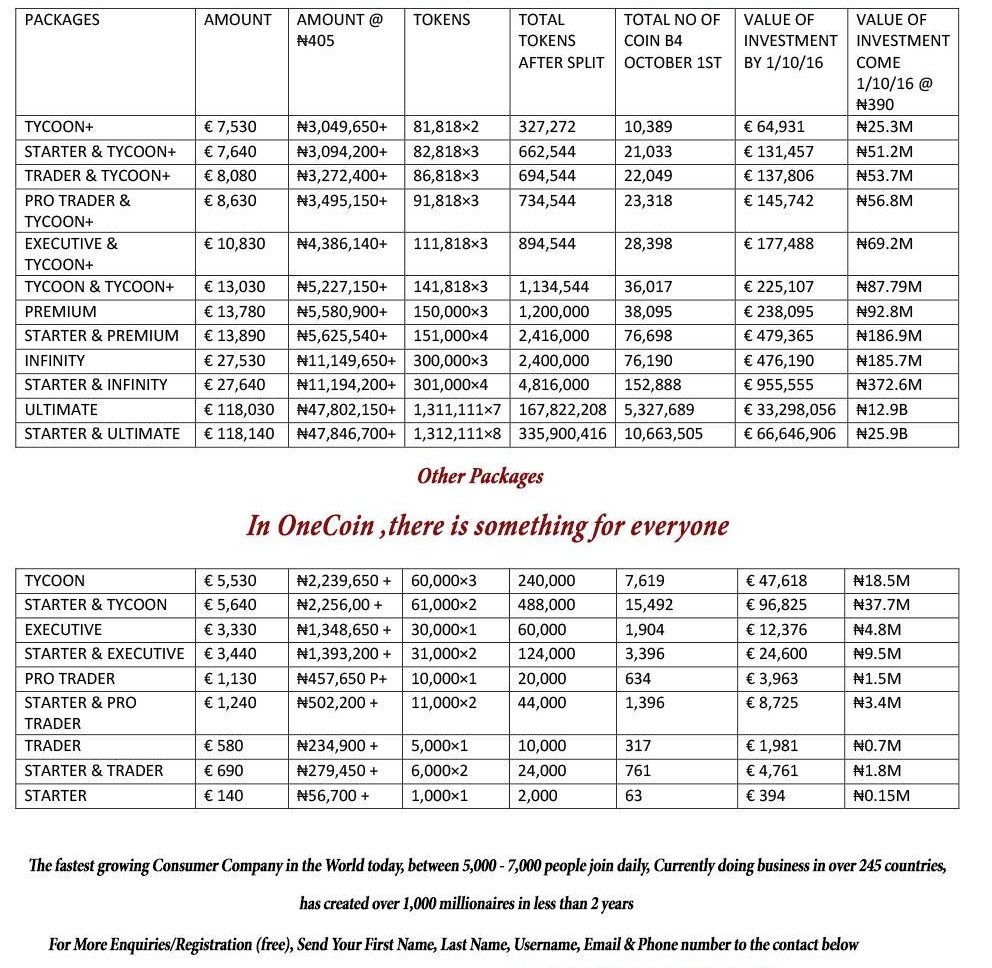

The cheapest package was €140, however they ranged from €140 to €118,000.

Dr Ruja persuaded people in more than 200 countries to buy educational materials and OneCoin tokens through spectacular premieres and attractive messaging. Course package buyers were supposed to get tokens that could be used to mine OneCoins. She assured people that they would become wealthy and that they were a part of something significant. Unfortunately, the “something large” turned out to be a huge con.

Reasons for the popularity of Onecoin

FOMO:

The investors had heard about others who’d struck it rich with Bitcoin and thought OneCoin was a fair shot.The fear among investors was that they might miss out on the next great thing.

Charisma of Dr Ruja:

Also, Many people were taken aback by Dr Ruja’s charisma and persuasiveness. Investors may not have fully grasped the technology, but they could imagine her speaking in front of large crowds or at the Economist conference. They were given copies of Forbes magazine with her face on the front cover, as well as photos of her degrees from Oxford University and a PhD from Konstanz.

Ruja Ignatova’s story is filled with seemingly revolutionary ideas, grand promotional events, flashing lights, and carefully crafted slogans, but the ending has yet to be written. OneCoin was a tried-and-true pyramid scheme with a digital twist – a new and wildly successful version of the old plan. Certainly, scams can be avoided by conducting extensive research about the project, reviewing the audit report, and connecting with the project leadership.

Mr. Bjorn Bjercke was fortunate enough not to accept the job offer, and the rest is history.

Pingback: 5 Points to Focus Before Investing in Cryptocurrency | Niripto

Pingback: Why do we love listening to sad music? | Niripto